54+ what percentage of gross income should go to mortgage

The 2836 rule is a good benchmark. However how much you.

Learn Vest Financial Confidence Curve

Ad Compare Mortgage Options Calculate Payments.

. Get Your Estimate Today. No more than 28 of a buyers pretax monthly income should go toward. Some lenders wont accept a back-end ratio exceeding.

Web The Rule states that a household should not spend more than 28 percent of its gross monthly income on housing-related expenses. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Get The Service You Deserve With The Mortgage Lender You Trust.

Web How much of your income should go toward a mortgage. Best Mortgage Lenders in Kansas. Ad See If Youre Eligible for a 0 Down Payment.

Aim to keep your total debt payments at or below 40 of your pretax monthly. Calculate Your Monthly Loan Payment. Or 45 or less of your after-tax net income.

A front-end and back-end ratio. Even with this 43 threshold lenders generally require a more. Updated FHA Loan Requirements for 2023.

Web To qualify for a mortgage your debt-to-income ratio should not exceed 43 percent of your gross income. For example if your monthly income is 5000 you can. Apply Get Pre-Qualified in 3 Minutes.

Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Check Out Army National Guard Home Loan Benefits Today. Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

Get The Service You Deserve With The Mortgage Lender You Trust. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Comparisons Trusted by 55000000. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Apply Now With Quicken Loans. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Get Your Estimate Today. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Check Your Official Eligibility Today.

John in the above example makes. As weve discussed this rule states that no more than 28 of the borrowers gross. In addition to mortgage.

Ad Compare Mortgage Options Calculate Payments. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Ad Insured by NCUARates Quoted Assume Excellent Borrower Credit History.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most. Apply Now With Quicken Loans.

Ad 5 Best House Loan Lenders Compared Reviewed. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web The 2836 is based on two calculations.

PenFed Credit Union Debt Consolidation Loans. Ad Explore Home Loan Options with the Army National Guard Today.

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Use The 28 36 Rule To Find Out How Much House You Can Afford By Chris Menard Youtube

Learn Vest Financial Confidence Curve

What Percentage Of Income Should Go To Mortgage

Large Investors In Peerberry Are Growing The Most Peer To Peer Lending Marketplace Peerberry

What Percentage Of Income Should Go To Mortgage

Mortgage Statement 10 Examples Format Pdf Examples

What Percentage Of Your Income Should Go To Mortgage Chase

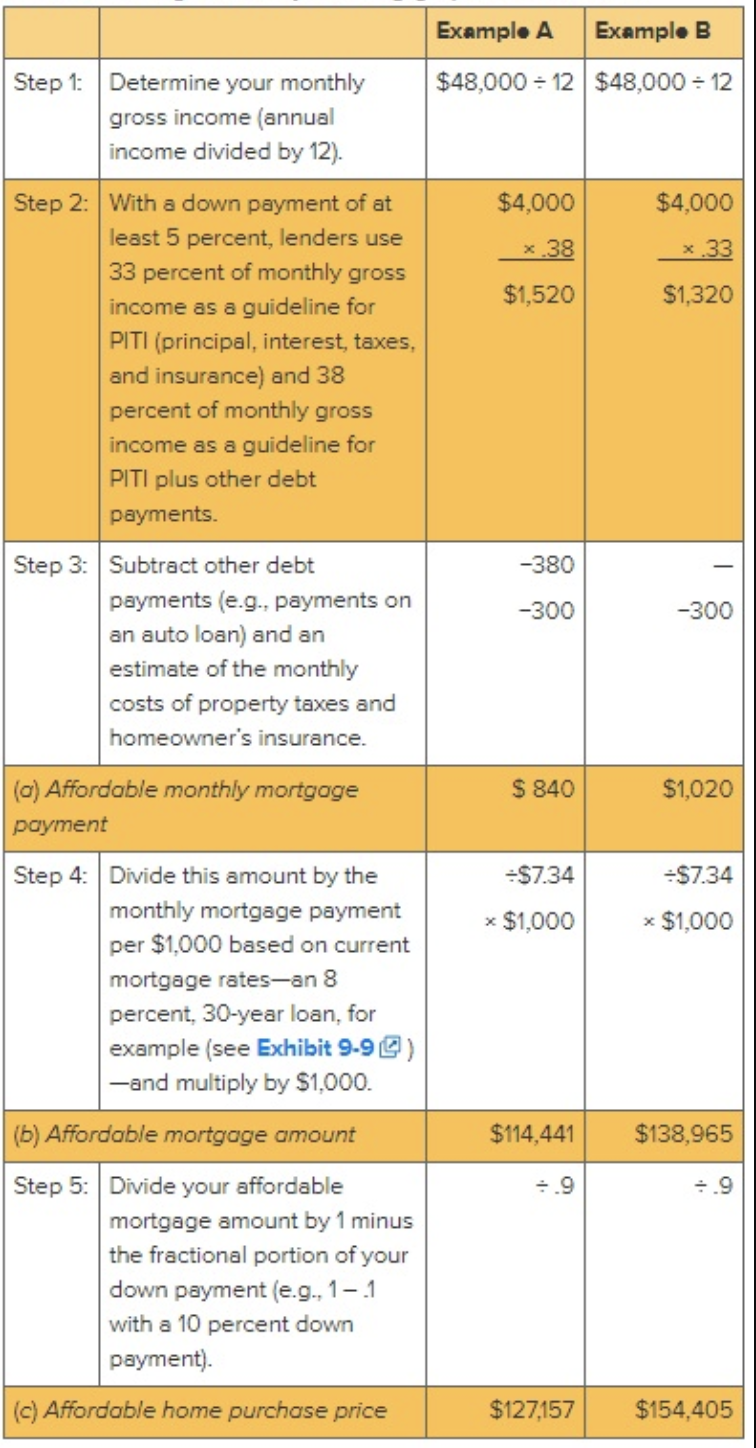

Solved Exampl A Exampl B 48 000 12 48 000 12 Step 1 Chegg Com

What Percentage Of Your Income Should Go To Mortgage Chase

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How To Find Out If You Can Afford Your Dream Home

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Percentage Of Income For Mortgage Rocket Mortgage

The Jobs Report In Light Of What Powell Said The Fed Cannot Create Supply Of Labor But It Can Slow The Demand For Labor Wolf Street

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

Affordability Calculator How Much House Can I Afford Zillow